2026-01-25

Silver up 167%? Capacitor costs are climbing with raw materials. We analyze the data and provide actionable strategies for engineers and procurement to build supply chain resilience.

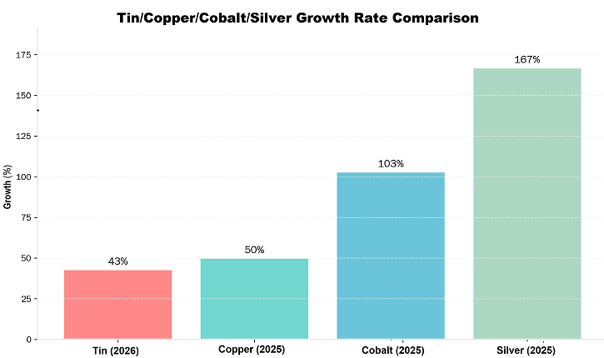

If your team is managing product development or procurement in 2026, capacitor pricing is likely back on your risk register. The common knowledge is clear: components are made of metal, and metal costs are going crazy. But what do the numbers actually tell us? With silver prices up an astonishing ~167% and critical materials like tin, copper, and cobalt rising sharply (between 43% and 103%), the impact on production costs isn't incremental—it's transformational. For engineers and buyers, moving from awareness to strategy is now critical.

Three major forces are converging, but it starts with the incontrovertible data from the mines and markets:

1.Raw Material Volatility: The Primary Catalyst. This is no longer speculation. The direct cost inputs for capacitor manufacturing have skyrocketed:

Silver (Electrode Material): Up ~167%. This precious metal is vital for conductive layers in many high-reliability MLCCs and other types, making this surge a direct hit to bill-of-material costs.

Tin, Copper, Cobalt (Solder, Leads, Electrolytes): Rising 43% to 103%. These aren't niche metals; they are foundational to soldering, internal construction, and chemical formulations across nearly all capacitor families.

The Ripple Effect: Tantalum, nickel, and specialized ceramic powders face similar pressures from EV and industrial demand, compounding the overall cost burden.

2.Concentrated Manufacturing & Geopolitics: A significant portion of global capacitor production resides in specific regions. Trade policies, logistical bottlenecks, and regional instability can immediately disrupt supply flows, creating allocation and premium pricing on top of material costs.

3.Sustained Demand in Growth Sectors: The capacitors needed for EVs, renewable energy systems, and advanced industrial IoT are not the commodity parts of a decade ago. They are higher-spec, more complex components, competing for constrained production lines already strained by input costs.

Reacting to price notifications is a losing strategy. Proactivity wins. Here are three key pillars for adaptation:

Design for Availability (DfA): This is the most powerful lever. Engage with your component suppliers early in the design phase. Challenge every capacitor spec in light of these costs: Is an alternate technology (e.g., polymer vs. tantalum) or a wider tolerance acceptable? Designing in flexibility (e.g., a footprint that fits multiple case sizes) is now a direct cost-containment measure.

Deepen Supplier Partnerships: Move beyond transactional relationships. Your trusted distributor and manufacturer partners have the market intelligence you need. Transparent forecasts and strategic discussions can lead to Long-Term Agreements (LTAs) or preferred allocation, providing a buffer against the volatile commodity markets reflected in the data above.

Holistic BOM Review: Isolate capacitors that are high-cost, single-source, or long-lead-time. For these, consider strategic buffer stock or formal second-source qualification. The cost of a line-down scenario far outweighs the carrying cost of critical inventory.

In today's market, supply chain resilience is as critical as electrical performance. The 167% increase in silver is more than a statistic; it's a signal. The companies navigating this most effectively are those viewing component selection not just as an engineering task, but as a cross-functional strategy imperative.

Partner for Perspective:

Navigating these market fundamentals requires both technical knowledge and commercial insight. Hongda capacitors provides more than parts; we provide market-aware solutions. Our technical sales team is ready to help you review your BOM in light of current cost drivers, identify risk components, and source validated alternatives to protect your project's timeline and budget.

Ready to build a more resilient supply chain? Contact our team today for a complimentary component strategy consultation.

For more details, pls contact: smile@hongdacap.com.hk

Mob: +86 180 2905 5827 (WhatsApp/WeChat/Skype)